Renters Insurance in and around Lapeer

Renters of Lapeer, State Farm can cover you

Rent wisely with insurance from State Farm

Would you like to create a personalized renters quote?

Home Sweet Home Starts With State Farm

Trying to sift through coverage options and deductibles on top of keeping up with friends, family events and managing your side business, can be a lot to juggle. But your belongings in your rented home may need the remarkable coverage that State Farm provides. So when trouble knocks on your door, your souvenirs, home gadgets and sports equipment have protection.

Renters of Lapeer, State Farm can cover you

Rent wisely with insurance from State Farm

Why Renters In Lapeer Choose State Farm

Renters insurance may seem like the least of your concerns, and you're wondering if it can actually help protect your belongings. But take a moment to think about how much it would cost to replace all the personal property in your rented townhome. State Farm's Renters insurance can help when fires or break-ins damage your possessions.

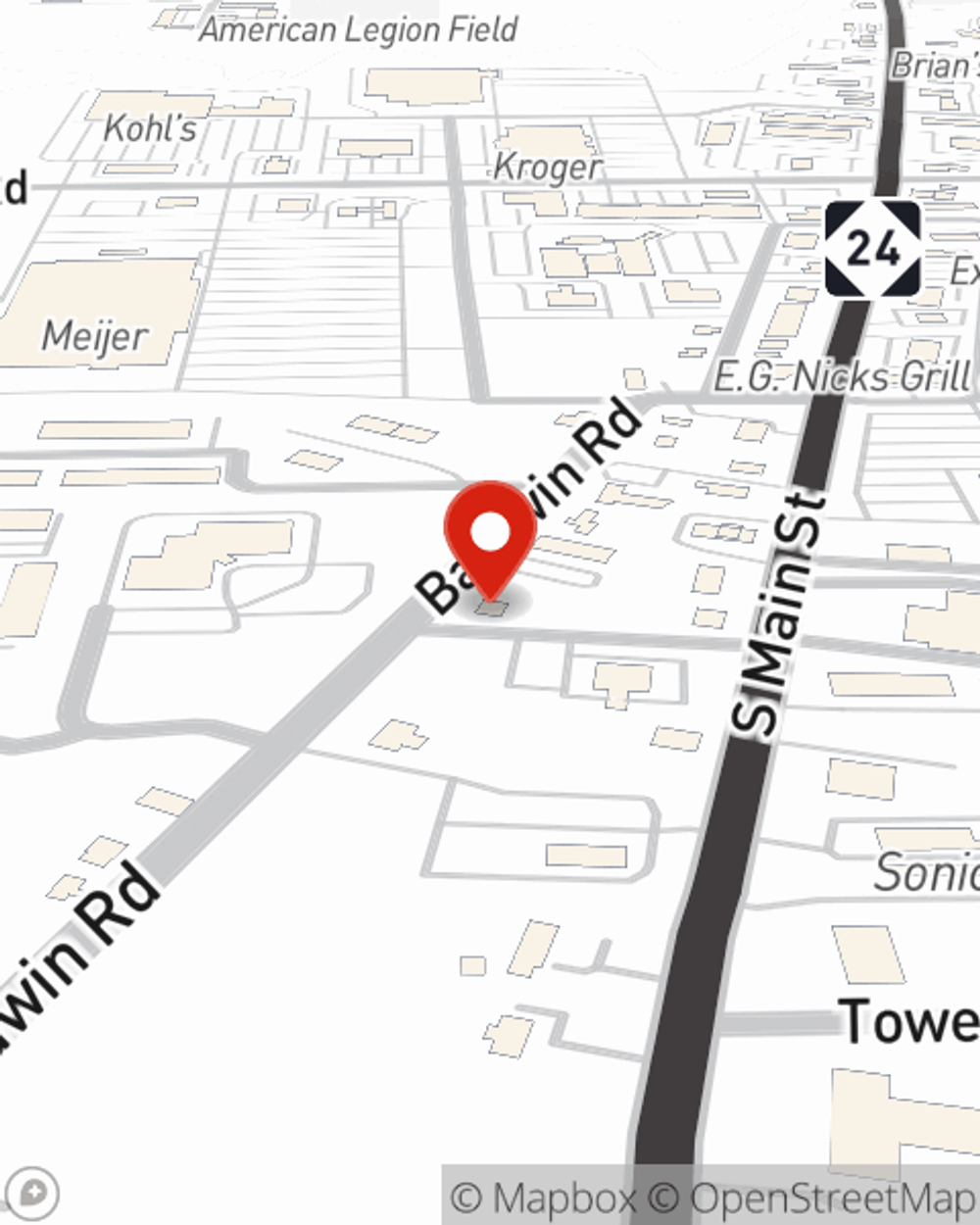

As a commited provider of renters insurance in Lapeer, MI, State Farm aims to keep your home safe. Call State Farm agent Keith Byard today for help with all your renters insurance needs.

Have More Questions About Renters Insurance?

Call Keith at (810) 664-8925 or visit our FAQ page.

Simple Insights®

Help control your home monitoring system with your smartphone

Help control your home monitoring system with your smartphone

The latest generation of smart home monitoring goes far beyond smoke detection and intrusion alerts.

Tips for renting a storage unit

Tips for renting a storage unit

Tips for selecting a rental storage unit, packing personal possessions, insurance for storage and how do storage units work.

Keith Byard

State Farm® Insurance AgentSimple Insights®

Help control your home monitoring system with your smartphone

Help control your home monitoring system with your smartphone

The latest generation of smart home monitoring goes far beyond smoke detection and intrusion alerts.

Tips for renting a storage unit

Tips for renting a storage unit

Tips for selecting a rental storage unit, packing personal possessions, insurance for storage and how do storage units work.